How to Apply for Biberk Business Insurance: A Comprehensive Guide

Delving into the realm of business insurance, this guide sheds light on the intricacies of applying for Biberk business insurance. Get ready to uncover the key steps and essential information needed to safeguard your business with the right coverage.

Moving forward, let's explore the details of this crucial process and navigate through the nuances of securing Biberk business insurance effectively.

Understand Business Insurance

Business insurance is a crucial part of protecting your company from unexpected events that could result in financial loss. By having the right insurance coverage, you can safeguard your business assets and ensure its continuity in the face of various risks.

Types of Business Insurance

- General Liability Insurance: This type of insurance protects your business from claims related to bodily injury, property damage, or advertising injury.

- Property Insurance: Property insurance covers damage to your business property, including buildings, equipment, and inventory, due to events like fire, theft, or vandalism.

- Business Interruption Insurance: Business interruption insurance helps cover lost income and expenses if your business operations are disrupted due to a covered event.

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage protects your business from claims of negligence or inadequate work.

Risks Covered by Business Insurance

- Natural Disasters: Business insurance can provide coverage for damage caused by natural disasters such as hurricanes, earthquakes, or floods.

- Lawsuits: In the event of a lawsuit against your business, insurance can help cover legal fees, settlements, and judgments.

- Cyberattacks: With the increasing risk of cyber threats, having cyber insurance can protect your business from data breaches and other cyber incidents.

Research Biberk Business Insurance

When it comes to choosing an insurance provider for your business, it's essential to do thorough research to ensure you are getting the best coverage for your needs. Biberk is a well-known insurance provider that offers a variety of business insurance options tailored to different industries and business sizes.

Biberk’s Business Insurance Offerings

- Biberk provides comprehensive business insurance coverage for small to medium-sized businesses, including general liability, commercial property, and professional liability insurance.

- They also offer specialized insurance products for specific industries, such as technology, healthcare, and construction.

- Biberk's business interruption insurance helps cover lost income and operating expenses in case your business is temporarily shut down due to a covered peril.

Comparison with Other Providers

- Compared to other insurance providers, Biberk is known for its competitive rates and personalized customer service tailored to the unique needs of each business.

- Many customers appreciate Biberk's easy online application process and quick claims handling.

- While other providers may offer similar coverage options, Biberk stands out for its focus on customer satisfaction and industry expertise.

Reputation and Customer Reviews

- Biberk has built a strong reputation in the insurance industry for its reliability and financial stability.

- Customers often praise Biberk for its responsive customer support and efficient claims processing.

- Online reviews of Biberk are generally positive, with many customers highlighting their satisfaction with the coverage options and competitive pricing.

Determine Your Insurance Needs

Determining your insurance needs is crucial to protecting your business from potential risks and liabilities. By identifying the specific requirements of your business and understanding the coverage areas you need from Biberk Business Insurance, you can ensure that you are adequately protected.

Additionally, considering any additional considerations based on your industry can help tailor your insurance policy to meet your unique needs.

Identify Required Coverage Areas

- General Liability Insurance: Provides coverage for bodily injury, property damage, and advertising injury claims.

- Professional Liability Insurance: Protects against claims of negligence, errors, or omissions in the services provided.

- Property Insurance: Covers damage or loss of business property due to fire, theft, or other covered perils.

- Workers' Compensation Insurance: Mandatory in most states and provides benefits to employees injured on the job.

Consider Industry-specific Needs

- Healthcare Industry: Consider medical malpractice insurance to protect against claims of negligence or errors in patient care.

- Construction Industry: Look into builder's risk insurance to cover property damage during construction projects.

- Retail Industry: Theft and burglary insurance can help protect against losses due to theft or vandalism.

Application Process for Biberk Business Insurance

When applying for Biberk Business Insurance, it is essential to follow a step-by-step process and provide the necessary documentation to ensure a smooth application experience.

Step-by-Step Guide

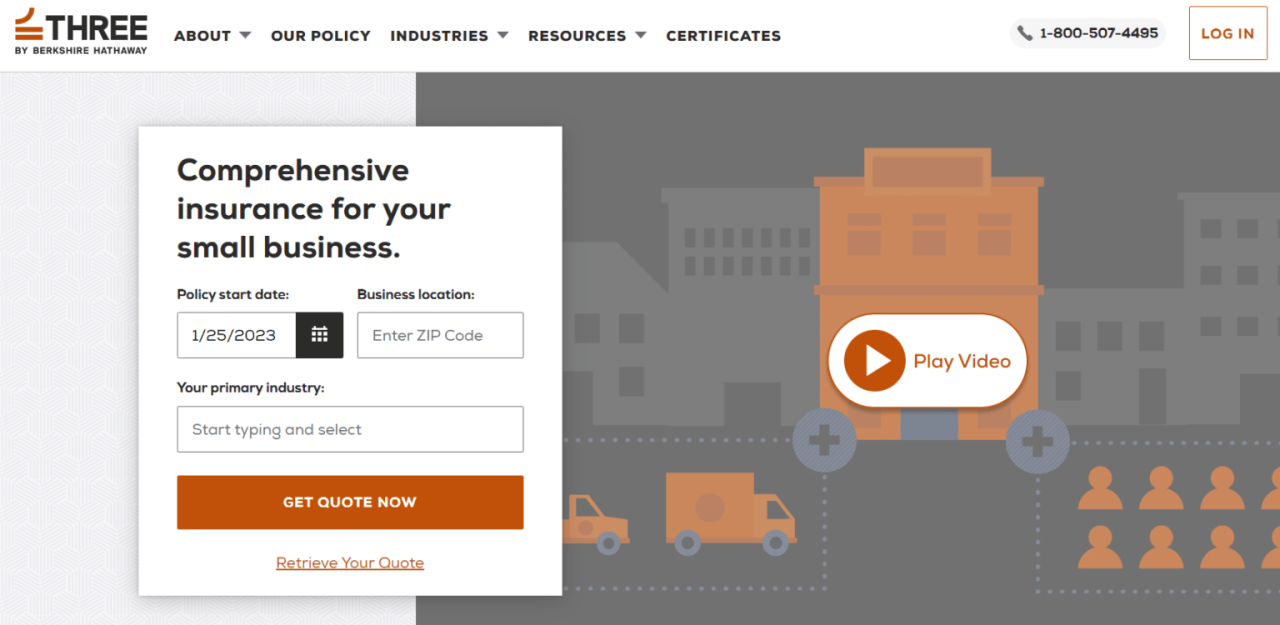

- Start by visiting the Biberk website or contacting a Biberk representative to initiate the application process.

- Fill out the required application form with accurate information about your business, including details about the nature of your operations, number of employees, revenue, and any specific insurance needs.

- Submit any additional documentation requested by Biberk to support your application, such as financial statements, business plans, or previous insurance history.

- Review the application carefully before submission to ensure all information is accurate and complete.

- Wait for the underwriting process to be completed by Biberk to receive a quote and further instructions regarding your insurance coverage.

- Once approved, review the policy details, make any necessary payments, and start enjoying the protection provided by Biberk Business Insurance.

Documentation Needed

- Business information: Details about your company, such as business structure, industry type, years in operation, and revenue.

- Financial documents: Tax returns, profit and loss statements, balance sheets, or any other financial records requested by Biberk.

- Previous insurance history: Information about your current or past insurance coverage, claims history, and any relevant insurance documents.

- Specific requirements: Any additional documents requested by Biberk based on your unique business needs or circumstances.

Eligibility Criteria

- Business type: Biberk Business Insurance caters to a wide range of industries and business sizes, but specific eligibility criteria may vary based on the nature of your operations.

- Insurance history: A positive insurance history with no significant claims may increase your chances of approval and favorable premium rates.

- Compliance: Ensuring that your business complies with relevant laws and regulations is crucial for eligibility for Biberk Business Insurance.

- Risk assessment: Biberk may conduct a risk assessment of your business to determine eligibility and appropriate coverage options.

Understanding Premiums and Coverage

When it comes to business insurance, understanding how premiums are calculated and the coverage provided is essential for making informed decisions. Premiums are the amount of money you pay to an insurance company in exchange for coverage against potential risks and losses.

Factors Affecting Premiums

- Industry Risk: Different industries have varying levels of risk, which can impact the cost of coverage. For example, a construction company may have higher premiums than a consulting firm due to the nature of the work.

- Business Size: The size of your business, including the number of employees and annual revenue, can also affect premiums. Larger businesses may have higher premiums to account for increased exposure to risk.

- Location: The location of your business can impact premiums, with factors such as local laws, weather conditions, and crime rates playing a role in determining the cost of coverage.

- Claims History: Your business's claims history, including the frequency and severity of past claims, can influence premiums. A history of frequent claims may lead to higher premiums.

Tips for Optimizing Coverage and Costs

- Assess Your Needs: Conduct a thorough evaluation of your business operations and risks to determine the appropriate level of coverage needed.

- Bundle Policies: Consider bundling multiple types of insurance policies with the same provider to potentially receive discounts on premiums.

- Review Regularly: Regularly review your insurance coverage to ensure it aligns with your current business needs and make adjustments as necessary.

- Work with an Agent: Consult with an insurance agent to help navigate the complexities of business insurance and find the best coverage options at competitive rates.

Conclusive Thoughts

In conclusion, applying for Biberk business insurance is a vital step in protecting your business from unforeseen risks. Armored with this knowledge, you can make informed decisions to ensure the security and longevity of your enterprise.

Common Queries

What documents are required for applying for Biberk business insurance?

Typically, you will need documents such as identification proof, business registration papers, financial statements, and details about your business operations.

How long does it usually take to get approval for Biberk business insurance?

The approval timeline can vary, but once you submit a complete application with all necessary documents, it usually takes a few days to a couple of weeks for approval.

Can I customize my coverage with Biberk business insurance?

Yes, Biberk offers customizable coverage options to tailor the insurance to your specific business needs, providing flexibility and comprehensive protection.

Are there specific industries that Biberk specializes in for business insurance?

Biberk caters to a wide range of industries, including retail, technology, healthcare, and more, ensuring that businesses across various sectors can find suitable coverage.