How to Write a Business Plan for Investors: A Comprehensive Guide

Embarking on the journey of crafting a business plan for investors opens doors to a realm of possibilities and strategic decisions. This guide delves into the essential elements and strategies needed to captivate potential investors and secure funding.

Explore the intricacies of presenting a compelling business plan that showcases your vision and potential for growth.

Introduction to Business Plan for Investors

When seeking funding for a business venture, having a well-written business plan is crucial in attracting investors. A comprehensive business plan not only Artikels your vision and goals but also demonstrates the potential for growth and profitability, instilling confidence in potential investors.

Key Elements of a Business Plan for Investors

A business plan tailored for investors should include key elements that provide a clear overview of your business and its potential for success:

- An executive summary that captures the essence of your business and its unique value proposition.

- A detailed description of your business model, target market, and competitive analysis.

- Financial projections, including revenue forecasts, break-even analysis, and return on investment for potential investors.

- A marketing and sales strategy that Artikels how you plan to acquire customers and generate revenue.

- Information about your management team, their experience, and how their skills contribute to the success of the business.

Main Goals of a Business Plan for Investors

When targeting potential investors, the primary goals of a business plan are to:

- Convey a compelling business opportunity that aligns with investors' interests and objectives.

- Showcase the potential for growth and profitability, highlighting the scalability of the business model.

- Demonstrate a solid understanding of the market, competitive landscape, and potential risks involved.

- Earn the trust and confidence of investors by presenting a well-thought-out plan with realistic goals and strategies for success.

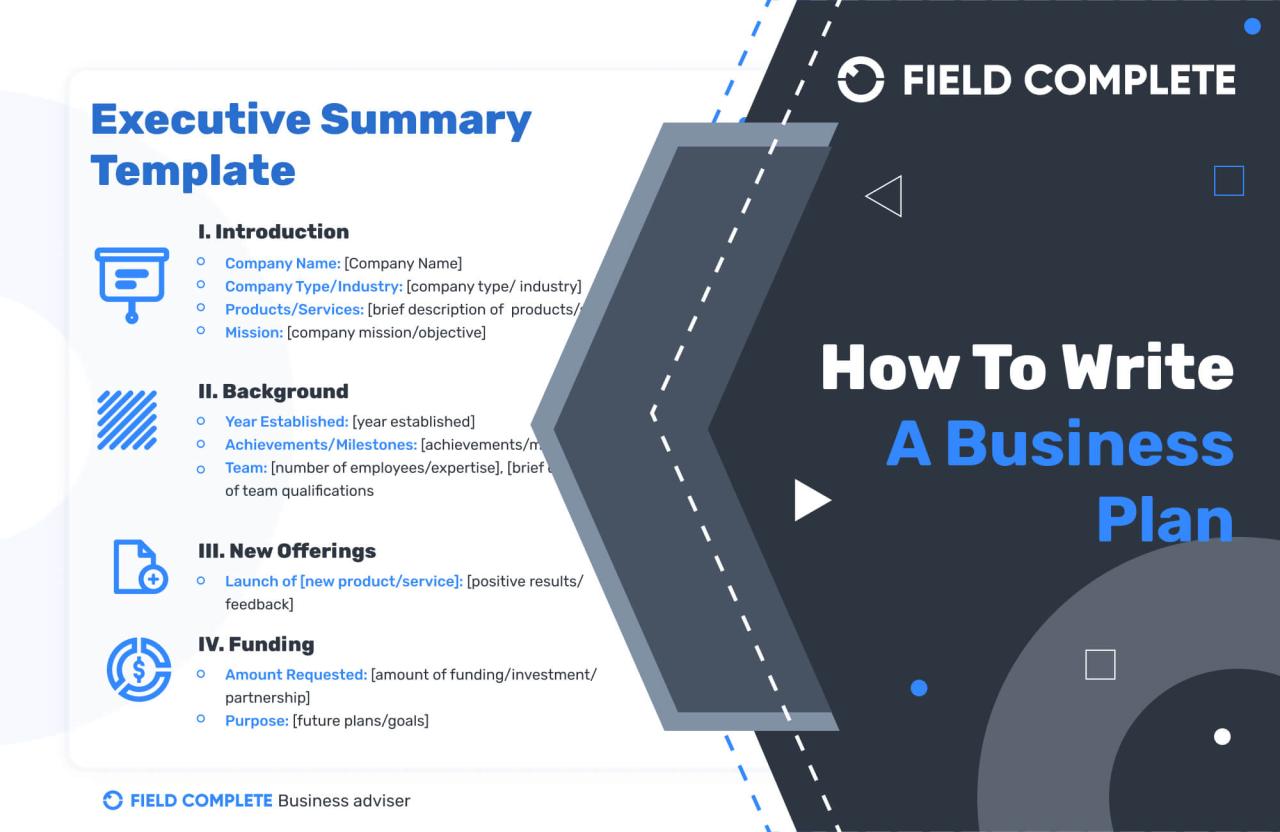

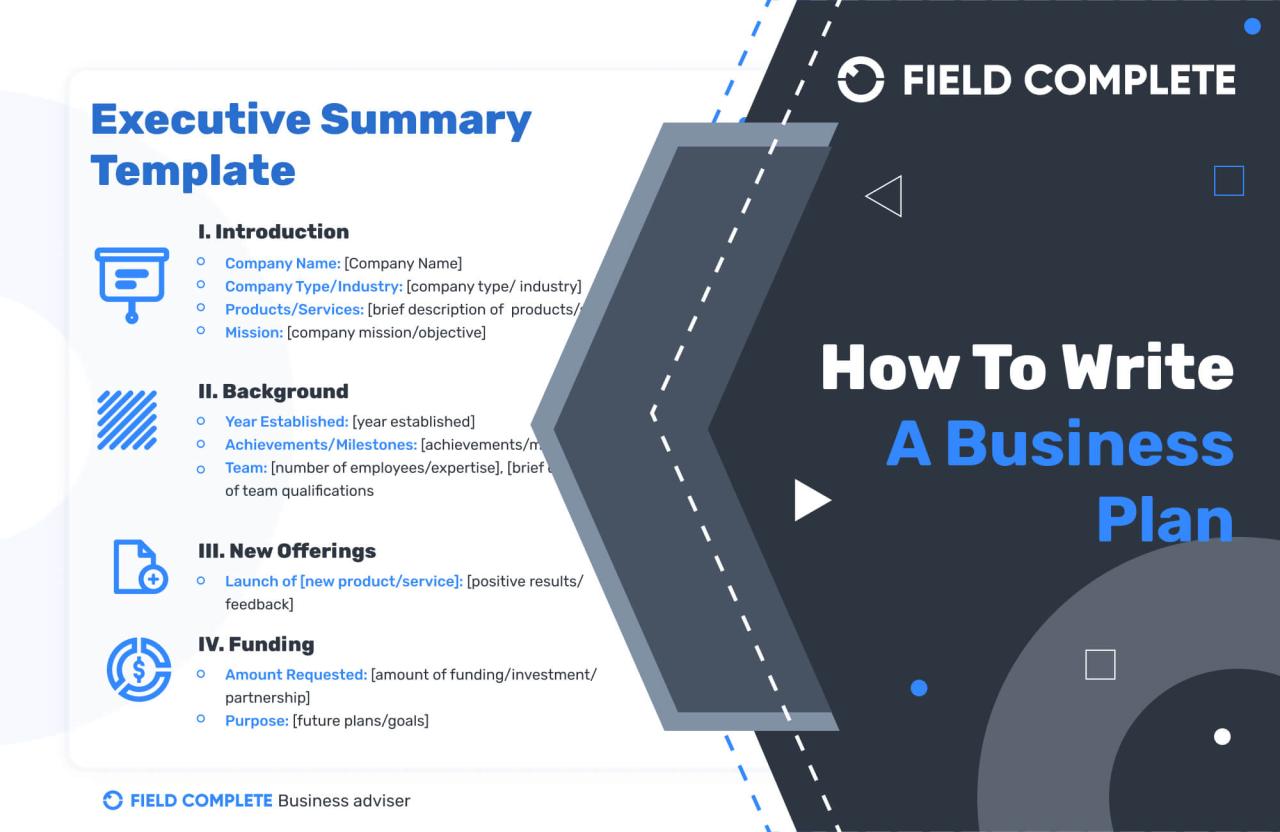

Executive Summary

An executive summary serves as a brief overview of the business plan, providing investors with a snapshot of the key points and potential of the business. It is crucial in capturing the interest of investors and convincing them to delve deeper into the details of the plan.

Purpose of the Executive Summary

An effective executive summary should include the following essential components:

- A brief description of the business and its unique value proposition.

- An overview of the target market and the problem the business aims to solve.

- Financial highlights, such as revenue projections and funding requirements.

- A summary of the business strategy and how it plans to achieve its goals.

- Information about the founding team and their expertise.

- A compelling conclusion that reinforces the potential for success and the investment opportunity.

Tips for Effective Summary

- Keep it concise and focused on the most critical aspects of the business plan.

- Highlight the unique selling points and competitive advantages of the business.

- Use clear and compelling language to engage the reader and convey the business's potential.

- Avoid technical jargon or unnecessary details that may overwhelm or confuse investors.

- Ensure the summary is well-structured and flows logically to maintain the reader's interest.

Company Description

When creating the company description section of a business plan for investors, it is crucial to provide a comprehensive overview of your company. This section should include key information such as the company's history, mission, vision, values, products or services offered, target market, unique selling proposition, and competitive advantage.

Effectively Communicating Mission, Vision, and Values

To effectively communicate your company's mission, vision, and values to investors, it is essential to be clear, concise, and compelling. Your mission statement should clearly define the purpose of your company and what you aim to achieve. Your vision statement should Artikel your long-term goals and aspirations.

Your values should reflect the guiding principles and beliefs that drive your company's culture and decision-making processes. By articulating these elements effectively, you can convey a strong sense of purpose and direction to potential investors.

Examples of Successful Company Descriptions

Airbnb

"Belong Anywhere"Airbnb's mission is to create a world where anyone can belong anywhere, providing unique travel experiences that promote belonging and community.

-

Tesla

"To accelerate the world's transition to sustainable energy"

- Tesla's vision is to lead the way in sustainable energy solutions, revolutionizing the automotive industry with electric vehicles and renewable energy products.

- Starbucks' values focus on creating a welcoming environment that fosters connections and positive experiences for customers and employees alike.

Starbucks

"To inspire and nurture the human spirit – one person, one cup, and one neighborhood at a time."

By studying successful company descriptions like these, you can gain insight into how to effectively communicate your own company's mission, vision, and values in a compelling and impactful way.

Market Analysis

When creating a business plan for investors, conducting a thorough market analysis is crucial to demonstrate a deep understanding of the industry landscape and potential opportunities for growth. Investors want to see that you have a clear picture of the market in which your business operates, including the target audience and competitive landscape.

This section helps investors assess the feasibility and potential success of your business idea.

Key Components of Market Analysis

- Market Trends: Provide an overview of current and future trends in the industry that could impact your business. This shows investors that you are aware of the market dynamics and are prepared to adapt to changes.

- Target Audience: Define your target market segment, including demographics, psychographics, and buying behaviors. Explain how you plan to reach and engage with your target audience to drive sales and growth.

- Competitive Landscape: Identify key competitors in the market and analyze their strengths, weaknesses, opportunities, and threats. Highlight what sets your business apart and your competitive advantage.

Products or Services

When showcasing the products or services offered by your business in a business plan, it is essential to provide a clear and concise description that highlights the unique selling points and competitive advantages.

Key Points to Highlight:

- Clearly define the products or services being offered, including their features and benefits.

- Highlight what sets your products or services apart from competitors.

- Showcase any innovative or unique aspects that make your offerings stand out in the market.

- Include any patents, trademarks, or proprietary technology that give your business a competitive edge.

Marketing and Sales Strategy

In a business plan for investors, outlining a robust marketing and sales strategy is crucial as it demonstrates how the company plans to attract customers, generate revenue, and ultimately achieve growth. Investors want to see a well-thought-out plan that shows a clear path to acquiring customers and increasing sales.

A strong marketing and sales strategy not only highlights the company's understanding of its target market but also showcases its ability to adapt to changes in consumer behavior and market trends.

Key Elements of a Marketing and Sales Strategy Section

When including a marketing and sales strategy section in a business plan, key elements to consider are:

- Target Market Analysis: Identify the specific demographics, needs, and preferences of the target market.

- Unique Selling Proposition (USP): Define what sets the company's products or services apart from competitors.

- Pricing Strategy: Artikel how pricing decisions are made to maximize revenue and profitability.

- Distribution Channels: Describe how products or services will reach customers efficiently.

- Promotional Activities: Detail the marketing tactics and campaigns planned to create awareness and drive sales.

- Sales Strategy: Explain the sales process, including lead generation, conversion, and customer retention strategies.

By including these elements in the marketing and sales strategy, investors can see how the company plans to position itself in the market, reach customers effectively, and drive revenue growth.

Demonstrating Scalability and Growth Potential

One way to demonstrate scalability and growth potential through the marketing and sales approach is by showing how the strategy can be expanded as the business grows. This can include:

- Scalable Marketing Campaigns: Develop campaigns that can reach a broader audience without significantly increasing costs.

- Sales Team Expansion: Plan for the growth of the sales team to handle increased demand and reach new markets.

- Partnerships and Alliances: Explore opportunities to collaborate with other businesses to expand reach and customer base.

- Data-Driven Decision-Making: Use data analytics to optimize marketing and sales efforts and identify new growth opportunities.

Financial Projections

Creating realistic and data-driven financial forecasts is crucial when presenting a business plan to investors. It helps them understand the potential growth and profitability of the business, making it easier for them to make investment decisions.

Necessary Financial Projections

- Sales Forecast: Predict the sales revenue the business expects to generate over a specific period, usually three to five years.

- Profit and Loss Statement: Show the projected income, expenses, and profits over the same period.

- Cash Flow Statement: Artikel the cash coming in and going out of the business to ensure there is enough to cover expenses.

- Balance Sheet: Present the company's assets, liabilities, and equity at a specific point in time.

Presenting Financial Projections

- Use clear and concise language to explain the assumptions behind your financial forecasts.

- Include detailed footnotes and explanations for key figures to help investors understand the basis of your projections.

- Show sensitivity analysis to demonstrate how changes in key variables could impact the financial outcomes.

- Use visual aids like charts and graphs to make the data more digestible and engaging.

Team and Management

When it comes to writing a business plan for investors, showcasing the team and management structure is crucial. Investors not only want to see a great business idea but also want to know that the team behind the idea is capable of executing it effectively.

Importance of Introducing the Team Members

Introducing the team members in your business plan helps investors understand the human capital driving the business. It provides insight into the skills, experience, and expertise that each team member brings to the table, giving investors confidence in the team's ability to succeed.

Information to Include for Team Members

- Full names and positions of each team member

- Relevant education background and qualifications

- Previous work experience and roles in other companies

- Key skills and expertise that are valuable to the business

- A brief description of how each team member contributes to the overall success of the business

Highlighting Expertise and Experience

When highlighting the expertise and experience of the team members, it is important to focus on specific accomplishments and how they align with the goals of the business. Providing concrete examples of past successes, industry recognition, or relevant achievements can help instill confidence in investors regarding the team's capabilities.

Final Review

In conclusion, mastering the art of writing a business plan for investors is a pivotal step towards realizing your entrepreneurial dreams. By incorporating the key components discussed, you can confidently navigate the landscape of investment opportunities and propel your business towards success.

Expert Answers

What should be the main focus when writing a business plan for investors?

The main focus should be on clearly outlining your business goals, financial projections, and unique selling points to attract potential investors.

How important is the executive summary in a business plan for investors?

The executive summary is crucial as it provides a snapshot of the entire business plan, highlighting key aspects to grab investor attention.

What role does the team and management section play in a business plan for investors?

The team and management section showcases the expertise and experience of the individuals driving the business, instilling confidence in investors about the company's leadership.