Crafting the Best Business Line of Credit for Contractors

Delve into the world of business lines of credit tailored specifically for contractors as we explore key insights and considerations that can help in making informed financial decisions.

Unravel the complexities of different credit options and discover how contractors can benefit from the right business line of credit.

Understanding Business Lines of Credit

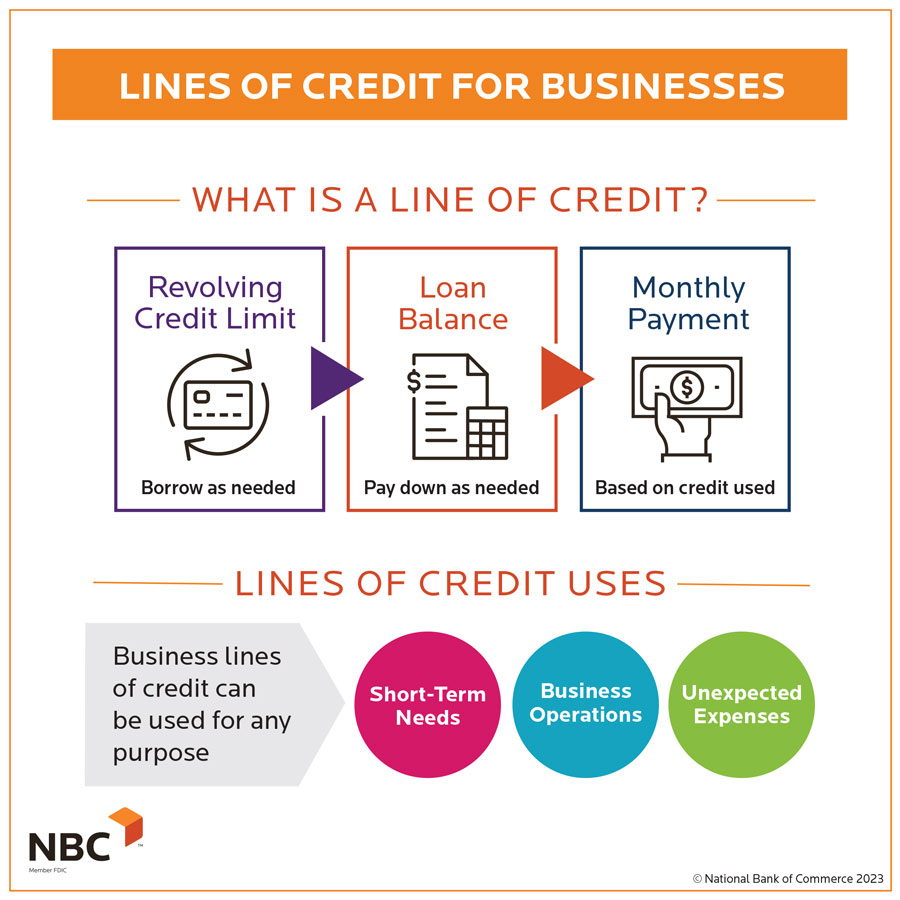

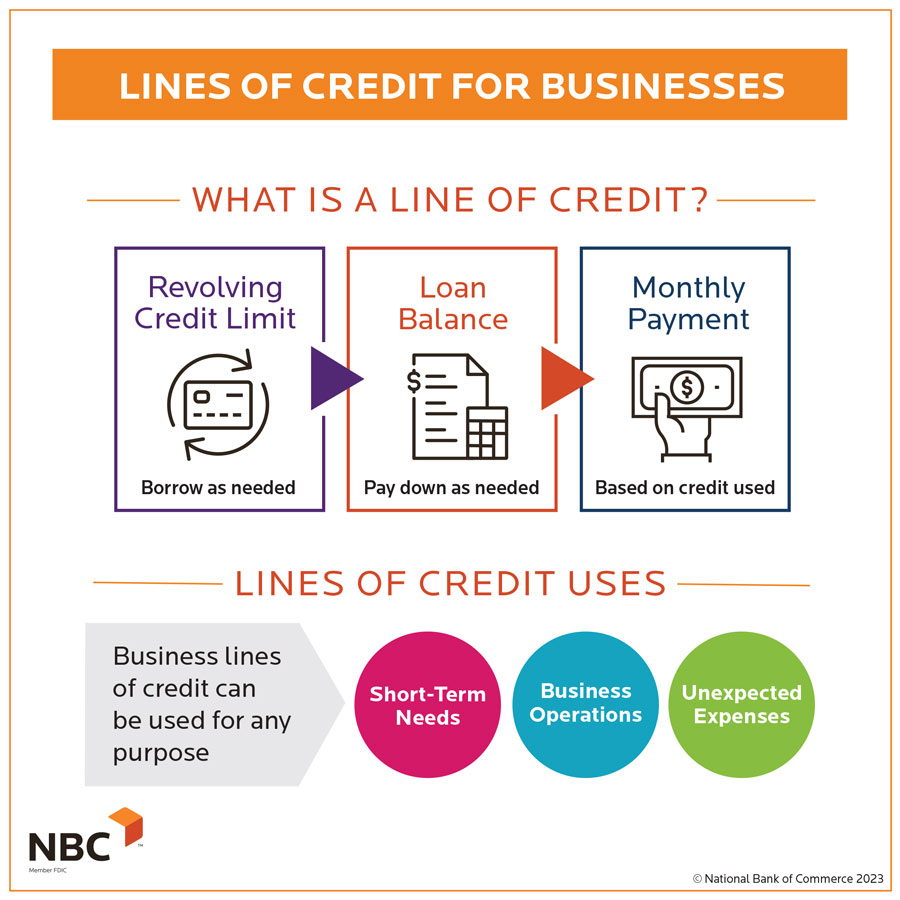

A business line of credit is a flexible form of financing that allows contractors to access funds up to a predetermined credit limit. Unlike a traditional loan, where you receive a lump sum upfront, a business line of credit gives you the ability to borrow funds as needed, up to your approved limit.

For contractors, a business line of credit can provide several benefits. It offers quick access to funds for purchasing materials, covering payroll, or handling unexpected expenses. This can help contractors manage cash flow fluctuations and take on new projects without delay.

Typical Features and Terms

- Revolving Credit:A business line of credit is revolving, meaning you can borrow, repay, and borrow again within your credit limit.

- Interest Rates:Interest is charged only on the amount you borrow, not the entire credit limit. Rates can be variable or fixed.

- Repayment Terms:Repayment terms vary but typically involve monthly payments based on the outstanding balance.

- Credit Limit:The maximum amount you can borrow under the line of credit, based on factors like creditworthiness and business financials.

- Secured vs. Unsecured:Business lines of credit can be secured by collateral or unsecured, depending on the lender's requirements.

Factors to Consider When Choosing the Best Business Line of Credit

When selecting the best business line of credit for contractors, several key factors need to be taken into consideration to ensure that it aligns with the specific needs of the business. Factors such as interest rates, fees, credit limits, repayment terms, flexibility, and accessibility play a crucial role in determining the most suitable option for contractors.

Importance of Interest Rates and Fees

Interest rates and fees are significant factors to consider when choosing a business line of credit. Contractors should compare different options to find competitive rates that are manageable within their budget. High-interest rates and excessive fees can significantly impact the overall cost of borrowing, affecting the profitability of the business in the long run.

Impact of Credit Limits and Repayment Terms

Credit limits and repayment terms are essential considerations for contractors as they determine the amount of credit available and the structure of repayments. Contractors need to assess their funding requirements and cash flow to choose a credit limit that meets their needs.

Additionally, favorable repayment terms, such as flexible schedules and manageable monthly installments, can ease financial strain and ensure timely repayments.

Flexibility and Accessibility

Flexibility and accessibility are key factors that contractors should prioritize when selecting a business line of credit. A flexible credit line allows contractors to access funds when needed and adjust borrowing according to fluctuating business requirements. Moreover, easy accessibility through online platforms or mobile applications simplifies the borrowing process and provides quick access to funds in times of urgency.

Top Providers Offering Business Lines of Credit for Contractors

When it comes to securing a business line of credit for contractors, it's essential to choose a reputable financial institution or lender that understands the unique needs of the construction industry. Here are some of the top providers offering business lines of credit tailored to contractors:

1. Wells Fargo

Wells Fargo is a well-known financial institution that offers business lines of credit specifically designed for contractors. They provide competitive rates and flexible terms to help contractors manage their cash flow effectively. The application process with Wells Fargo is relatively straightforward, but approval requirements may vary based on the contractor's financial history and business performance.

2. BlueVine

BlueVine is another popular choice for contractors looking for a business line of credit. They offer fast funding options and high credit limits to help contractors cover project costs and expenses. BlueVine also provides a user-friendly online application process, making it convenient for contractors to apply for a line of credit.

3. Fundbox

Fundbox is known for its quick and easy approval process, making it an attractive option for contractors in need of immediate financing. They offer lines of credit with transparent fees and no hidden costs, making it easier for contractors to budget and plan for their projects.

Fundbox also caters to contractors with less-than-perfect credit scores, providing more flexibility in the approval process.

4. OnDeck

OnDeck is a reputable lender that offers business lines of credit to contractors with varying credit profiles. They provide competitive rates and flexible terms, making it easier for contractors to access the funds they need for their projects. OnDeck also offers a simple online application process and quick approval turnaround times, ensuring that contractors can secure funding promptly.These are just a few of the top providers offering business lines of credit for contractors.

Each lender has its own unique terms, rates, and benefits, so it's essential for contractors to compare their options carefully and choose the provider that best meets their financing needs.

Tips for Maximizing the Benefits of a Business Line of Credit

When it comes to utilizing a business line of credit effectively, contractors can benefit greatly from implementing smart strategies. By understanding how to leverage their credit line for business growth and success, contractors can avoid common pitfalls and make the most out of this financial tool.

Effective Management Strategies

- Regularly monitor your credit utilization to ensure you are not exceeding your limits.

- Make timely payments to maintain a good credit score and strengthen your relationship with the lender.

- Use the credit line for short-term needs and avoid relying on it for long-term financing.

- Have a clear repayment plan in place to avoid accumulating unnecessary debt.

Leveraging Credit for Business Growth

- Invest in equipment and technology upgrades to improve efficiency and productivity.

- Use the credit line to fund marketing and advertising campaigns to attract more clients.

- Expand your business operations or open new locations with the help of the credit line.

- Take advantage of supplier discounts by paying early with funds from the credit line.

Avoiding Common Pitfalls

- Avoid using the credit line for personal expenses to maintain a clear separation between personal and business finances.

- Do not max out your credit line as it can negatively impact your credit score and financial stability.

- Avoid missing payments or making late payments to prevent additional fees and interest charges.

- Avoid using the credit line for risky investments or ventures that may not yield a positive return.

Final Summary

In conclusion, navigating the realm of business lines of credit for contractors requires a blend of strategic planning and financial acumen. By understanding the nuances of available options, contractors can pave the way for business growth and stability.

FAQ Corner

What are the typical features of a business line of credit?

Business lines of credit often offer flexible access to funds, revolving credit limits, and competitive interest rates.

How do interest rates impact the choice of a business line of credit?

Interest rates can significantly affect the cost of borrowing, making it crucial for contractors to compare rates and choose the most favorable option.

Which providers stand out for offering business lines of credit to contractors?

Leading financial institutions like ABC Bank and XYZ Lending specialize in providing tailored business credit solutions for contractors.