Business Loan vs Business Line of Credit: Understanding the Key Differences

Exploring the realm of business financing, the comparison between business loans and business lines of credit emerges as a crucial decision for entrepreneurs. Delving into the nuances of these financial tools promises a deeper insight into managing capital effectively.

When it comes to securing financial assistance for your business, understanding the disparities between a traditional loan and a line of credit is paramount. Let's unravel the intricacies of business loan vs business line of credit.

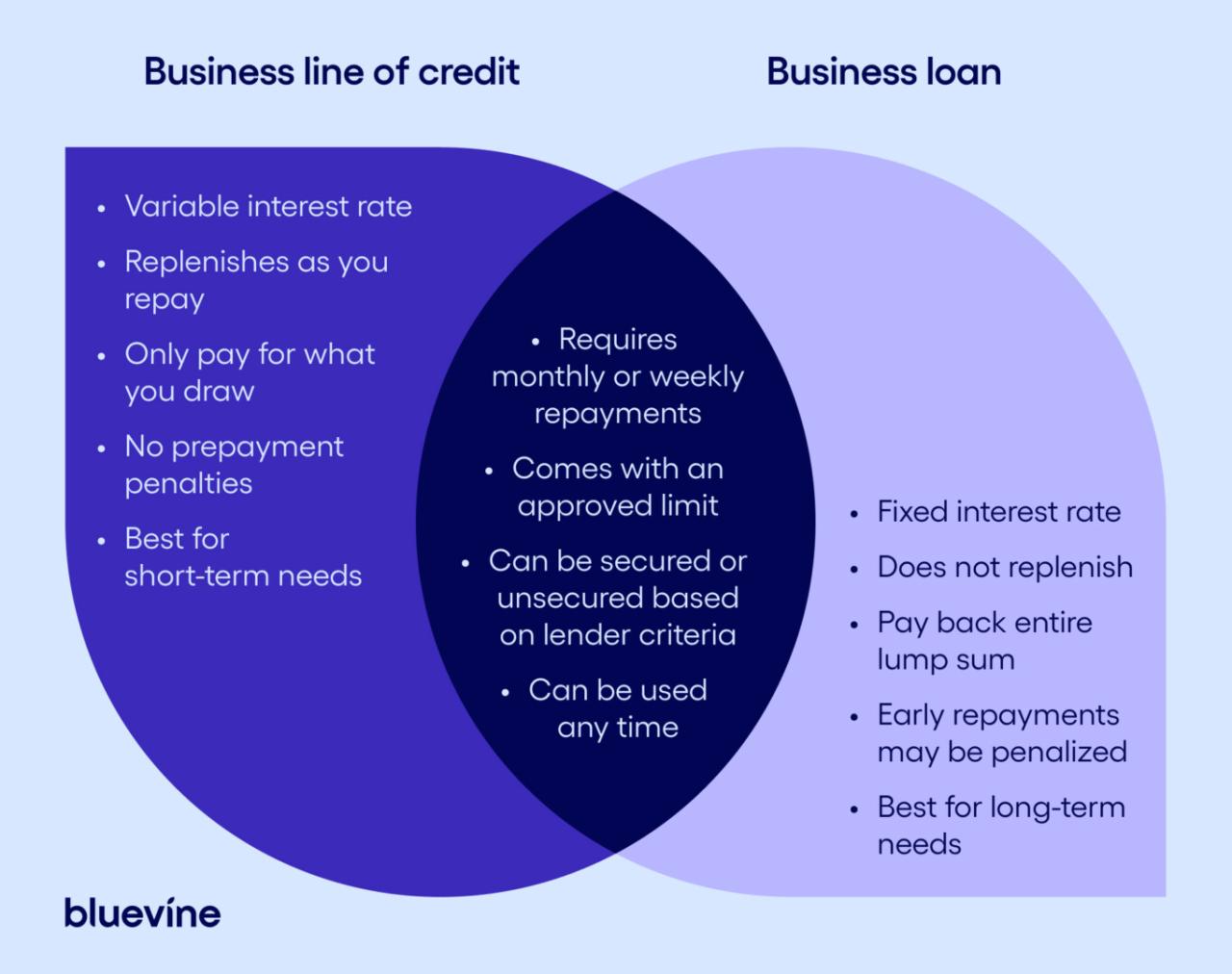

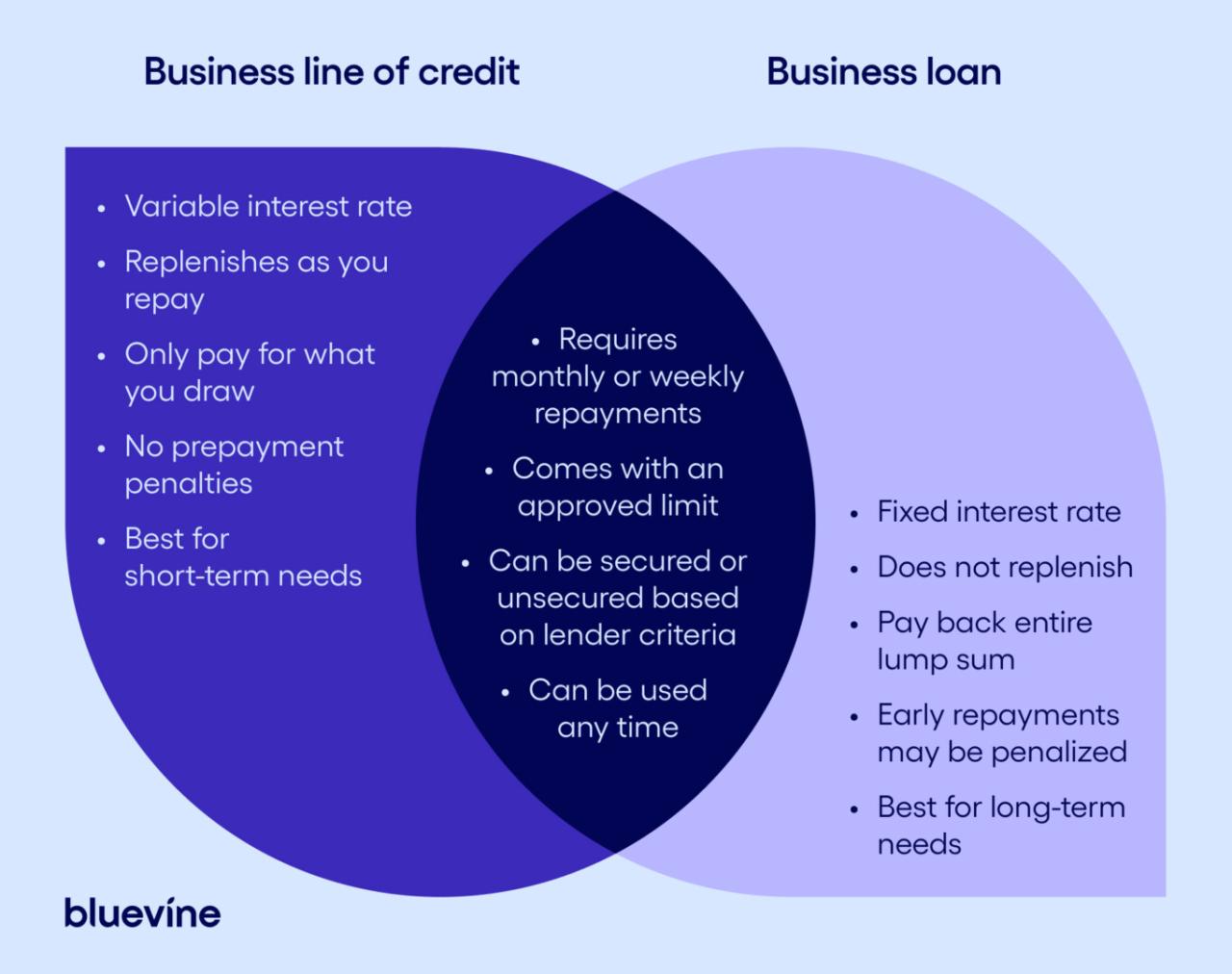

Business Loan vs. Business Line of Credit

A business loan is a lump sum of money borrowed from a financial institution that is repaid over time with interest. On the other hand, a business line of credit is a revolving credit account with a predetermined credit limit that can be used as needed and repaid with interest.

Main Differences

- Business Loan:

- Provides a lump sum of money upfront

- Fixed repayment schedule

- Interest is charged on the entire loan amount

- Business Line of Credit:

- Access to funds as needed within the credit limit

- Revolving credit with flexible repayment terms

- Interest is charged only on the amount used

Key Similarities

- Credit check and approval process

- Interest rates based on creditworthiness

- Used for business expenses, expansion, or cash flow management

Purpose and Usage

Business loans and business lines of credit are both valuable financial tools that can help businesses achieve their goals. Understanding the specific purposes and optimal usage of each can make a significant difference in the financial health of a business.When it comes to the purposes for which businesses typically use a business loan, there are several common scenarios.

Business loans are often utilized for large, one-time expenses such as purchasing equipment, expanding operations, or acquiring another business. These loans provide a lump sum of capital upfront, which can be repaid over a set period of time with a fixed interest rate.

Reasons for Choosing a Business Line of Credit

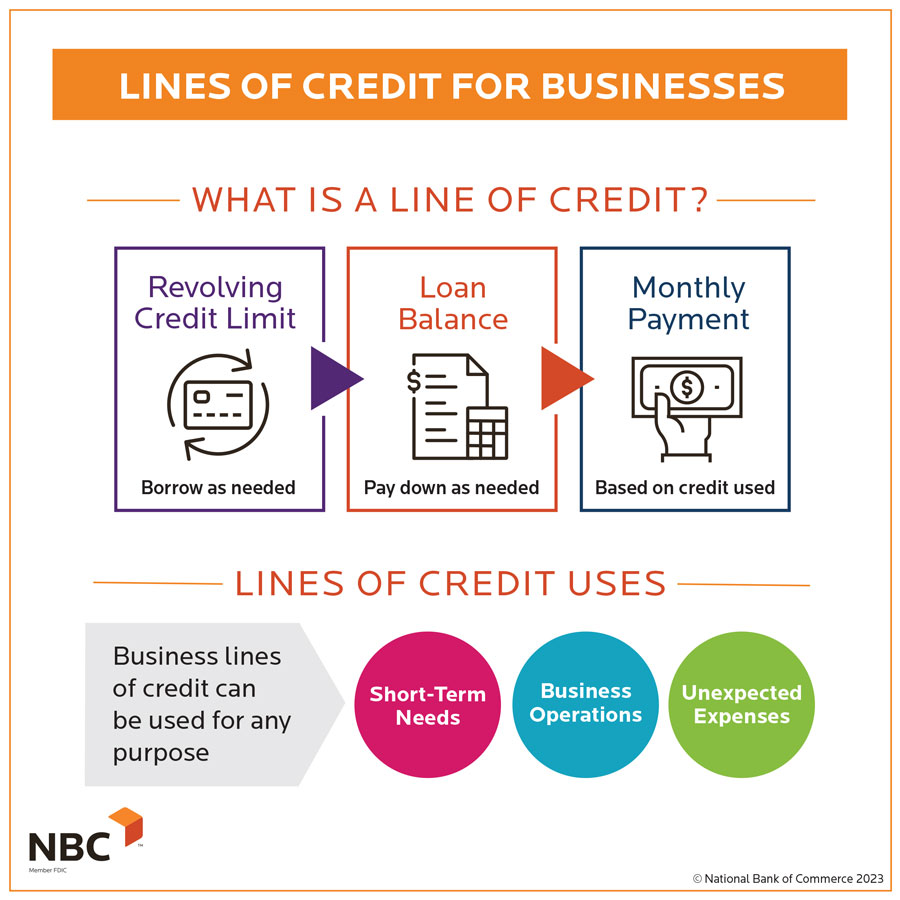

A primary reason why businesses opt for a business line of credit instead of a traditional loan is the flexibility it offers. With a business line of credit, a business has access to a revolving credit line that can be used as needed.

This means that businesses can draw funds up to a certain limit, repay them, and then draw again without having to reapply for a new loan each time. This flexibility makes a business line of credit ideal for managing cash flow fluctuations, covering unexpected expenses, or taking advantage of sudden opportunities.

Scenarios Favoring a Business Loan

While a business line of credit offers flexibility, there are specific scenarios where a business loan would be more suitable. For instance, if a business needs a large sum of money upfront for a specific purpose, such as purchasing real estate or funding a major expansion project, a business loan with a fixed term and repayment schedule may be more appropriate.

Additionally, if a business has a defined project with clear costs and timelines, a business loan can provide the necessary funds in a structured manner.Overall, understanding the purpose and optimal usage of business loans and business lines of credit can help businesses make informed financial decisions that align with their specific needs and goals.

Eligibility and Requirements

When it comes to obtaining financial assistance for your business, understanding the eligibility criteria and requirements is crucial. Below, we will explore the typical criteria and requirements for both business loans and business lines of credit.

Business Loan Eligibility and Requirements

- Business loans typically require the borrower to have a strong credit score, usually above 680, to qualify.

- Most lenders also look for a solid business plan, demonstrating the purpose of the loan and how it will be utilized.

- Collateral may be required for larger loan amounts, especially for new businesses or startups.

Business Line of Credit Qualifications

- Qualifying for a business line of credit usually involves having a credit score of 600 or higher, although some lenders may require a higher score.

- Lenders also consider the business's revenue and cash flow to determine the credit limit for a business line of credit.

- A history of successful business operations and a track record of making timely payments can strengthen the application for a line of credit.

Documentation and Paperwork Comparison

- Applying for a business loan typically requires more documentation, such as financial statements, tax returns, business licenses, and a detailed business plan.

- For a business line of credit, the documentation needed is usually less extensive, with requirements such as bank statements, proof of revenue, and personal and business tax returns.

- While business loans involve a more thorough review of the business's financial health and stability, business lines of credit focus more on the borrower's creditworthiness and repayment ability.

Repayment Terms and Flexibility

When it comes to repayment terms and flexibility, business loans and business lines of credit offer different options for businesses to manage their finances effectively.

Repayment Terms for Business Loans

Business loans typically have fixed monthly payments over a set term, ranging from a few months to several years. These payments include both principal and interest, providing a structured repayment plan for the borrower.

Flexibility with Business Lines of Credit

On the other hand, business lines of credit offer more flexibility in terms of repayment. Businesses can access funds as needed, only paying interest on the amount borrowed. There is no fixed monthly payment, and businesses can repay and borrow funds multiple times within their credit limit.

Effective Repayment Management

- For businesses with predictable cash flow and specific financing needs, a business loan with fixed monthly payments can help in budgeting and planning ahead.

- Businesses with fluctuating cash flow or seasonal demands may benefit more from a business line of credit, as they can borrow and repay funds as needed, without being tied to a fixed repayment schedule.

Outcome Summary

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)

In conclusion, navigating the terrain of business funding necessitates a clear understanding of the distinctions between a business loan and a business line of credit. Armed with this knowledge, entrepreneurs can make informed decisions to propel their ventures towards success.

Key Questions Answered

What is the main difference between a business loan and a business line of credit?

A business loan provides a lump sum amount with fixed repayments, while a business line of credit offers a revolving credit line that can be used as needed.

What are the common purposes for which businesses typically use a business loan?

Business loans are often used for expansion, purchasing equipment, or covering operational expenses.

What are the typical eligibility criteria for obtaining a business loan?

Eligibility criteria for business loans usually include credit score, business revenue, and business history.

How do repayment terms differ between a business loan and a business line of credit?

Business loans have fixed repayment schedules, while business lines of credit offer more flexibility in repayment options.