The Best Business Line of Credit for Contractors

Delving into the realm of business lines of credit for contractors, this introductory paragraph aims to pique the interest of readers with a blend of informative and engaging content.

Following this, we will explore the nuances of different types of business lines of credit, qualifications required, the application process, and the best lenders offering these financial solutions tailored for contractors.

Types of Business Lines of Credit

When it comes to business lines of credit for contractors, there are different types available to suit their specific needs and financial situations.

Secured vs. Unsecured Business Lines of Credit

Secured business lines of credit require collateral, such as equipment or property, to back the credit line. This reduces the risk for lenders, allowing for higher credit limits and lower interest rates. On the other hand, unsecured business lines of credit do not require collateral but may have stricter qualification requirements and higher interest rates.

Revolving vs. Non-Revolving Lines of Credit

Revolving lines of credit allow contractors to borrow funds up to a specified limit, repay them, and borrow again. This flexibility makes it suitable for ongoing expenses and projects. Non-revolving lines of credit provide a one-time lump sum that must be repaid in fixed installments over a set period, making it ideal for specific large expenses or projects.

Benefits for Contractors

- Secured business lines of credit can help contractors access higher credit limits and lower interest rates, making it easier to fund larger projects or investments.

- Unsecured business lines of credit are beneficial for contractors who may not have valuable collateral to secure a loan but still need flexible financing options.

- Revolving lines of credit offer contractors the ability to borrow funds as needed, manage cash flow fluctuations, and take advantage of opportunities as they arise.

- Non-revolving lines of credit provide contractors with a lump sum of funds for specific expenses or projects, ensuring predictable repayment terms and budgeting.

Qualifications and Eligibility Criteria

When applying for a business line of credit as a contractor, there are several qualifications and eligibility criteria to consider. These factors play a crucial role in determining whether you will be approved for the credit line.

Credit Score and Financial History

Your credit score and financial history are key factors that lenders consider when evaluating your eligibility for a business line of credit. A strong credit score and a positive financial history demonstrate your ability to manage finances responsibly and repay debts on time, increasing your chances of approval.

Annual Revenue and Time in Business

Lenders also look at your annual revenue and the amount of time your contracting business has been in operation. A higher annual revenue and a longer time in business can indicate stability and success, making you a more attractive candidate for a business line of credit.

Tips for Improving Eligibility

- Maintain a good credit score by paying bills on time and reducing debt.

- Increase your annual revenue by taking on more projects and expanding your client base.

- Build a strong financial history by keeping accurate records and managing cash flow effectively.

- Showcase your experience and expertise in the contracting industry to demonstrate your reliability and competence to lenders.

Application Process and Documentation

When applying for a business line of credit as a contractor, there are several steps involved in the process. Contractors need to provide specific documentation to support their application, and the approval timeline can vary depending on the lender's requirements.

Let's delve into the details below.

Steps in the Application Process

- Fill out the application form with accurate information about your business and financial history.

- Submit any required documentation, such as tax returns, bank statements, business financial statements, and proof of business ownership.

- Wait for the lender to review your application and make a decision.

- If approved, review and sign the terms of the business line of credit agreement.

- Access your credit line and start using it for your business needs.

Documentation Required

- Personal and business tax returns

- Bank statements

- Business financial statements (profit and loss statement, balance sheet)

- Proof of business ownership (business license, articles of incorporation)

Approval Timeline Variability

The approval timeline for a business line of credit can vary depending on the lender and the complexity of your application. Some lenders may provide instant approvals, while others may take a few days to weeks to review and approve your application.

Lender’s Evaluation Criteria

Lenders typically look for certain key factors when evaluating a contractor's application for a business line of credit. These may include:

- Strong credit history and score

- Stable business revenue and cash flow

- Credit utilization ratio

- Business longevity and industry experience

- Collateral (if required)

Best Lenders Offering Business Lines of Credit

When it comes to finding the best business lines of credit for contractors, it's essential to consider the top lenders in the industry. These lenders offer competitive interest rates, fees, and terms tailored to meet the needs of contractors. Let's take a look at some of the best lenders providing business lines of credit to contractors.

Top Lenders for Business Lines of Credit

- Bank of America: Bank of America offers flexible business lines of credit with competitive interest rates and terms. Contractors can benefit from their convenient online application process and excellent customer service.

- Wells Fargo: Wells Fargo is another top lender known for its business lines of credit tailored for contractors. They offer quick funding options and personalized solutions to meet the unique needs of contractors.

- Chase Bank: Chase Bank provides business lines of credit with low fees and competitive interest rates. Contractors can access funds easily and manage their credit line efficiently through Chase's online platform.

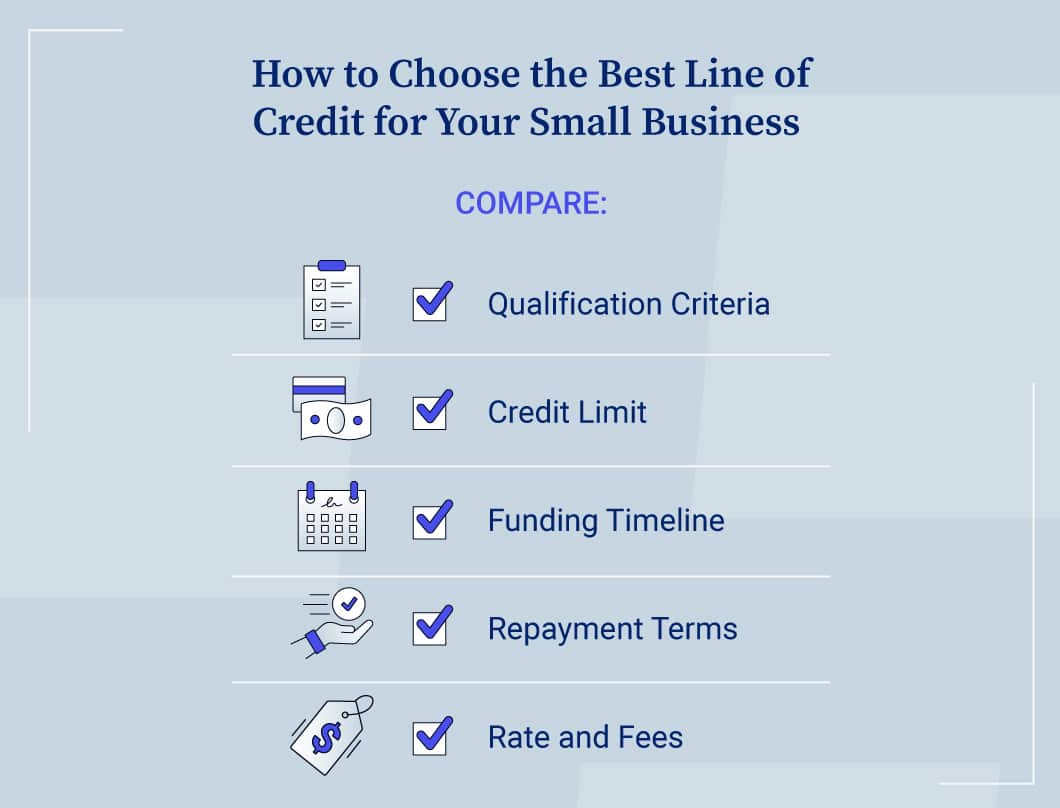

Comparison of Interest Rates, Fees, and Terms

- Bank of America: Interest rates starting at X%, annual fees of $X, and flexible repayment terms up to X years.

- Wells Fargo: Competitive interest rates starting at X%, minimal fees, and flexible terms based on the contractor's needs.

- Chase Bank: Low-interest rates starting at X%, no annual fees, and customizable terms to suit the contractor's financial goals.

Customer Reviews and Ratings

- Bank of America: Highly rated for excellent customer service and quick approval process.

- Wells Fargo: Positive reviews for personalized solutions and efficient funding options.

- Chase Bank: Good ratings for user-friendly online platform and responsive customer support.

Specific Loan Products for Contractors

- Bank of America Contractor Line of Credit: Designed specifically for contractors, offering flexible borrowing options and competitive rates.

- Wells Fargo Contractor Express Line of Credit: Quick access to funds for contractors with simplified application process and personalized support.

- Chase Bank Contractor Business Line of Credit: Tailored solutions for contractors with low fees, competitive rates, and easy account management tools.

Final Summary

Concluding our discussion on the best business line of credit for contractors, we have covered the essential aspects from types of credit lines to top lenders in the industry. This comprehensive guide aims to assist contractors in making informed decisions regarding their financial needs.

Common Queries

What are the typical qualifications needed for contractors to apply for a business line of credit?

Contractors usually need to demonstrate a solid credit score, financial stability, and a certain period of time in business to qualify for a business line of credit.

How can contractors improve their chances of qualifying for a business line of credit?

Contractors can enhance their eligibility by maintaining a good credit score, having a stable financial history, and showcasing a consistent revenue stream.

What documentation is usually required during the application process for a business line of credit?

Commonly, contractors need to provide documents such as financial statements, tax returns, bank statements, and business licenses.

How do lenders assess a contractor's application for a business line of credit?

Lenders typically look at factors like creditworthiness, revenue stability, business performance, and overall financial health when evaluating a contractor's application.

Which lenders are known for offering the best business lines of credit to contractors?

Several reputable lenders such as ABC Bank, XYZ Credit Union, and LMN Financial Services are recognized for providing tailored business lines of credit for contractors.