Crafting an Effective Biberk Insurance Review for Small Businesses

Embarking on a journey through the realm of Biberk insurance review for small businesses, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

As we delve deeper into the realm of insurance for small businesses, a plethora of insights and benefits emerge, shedding light on the crucial role that Biberk Insurance plays in safeguarding the interests of entrepreneurs.

Introduction to Biberk Insurance

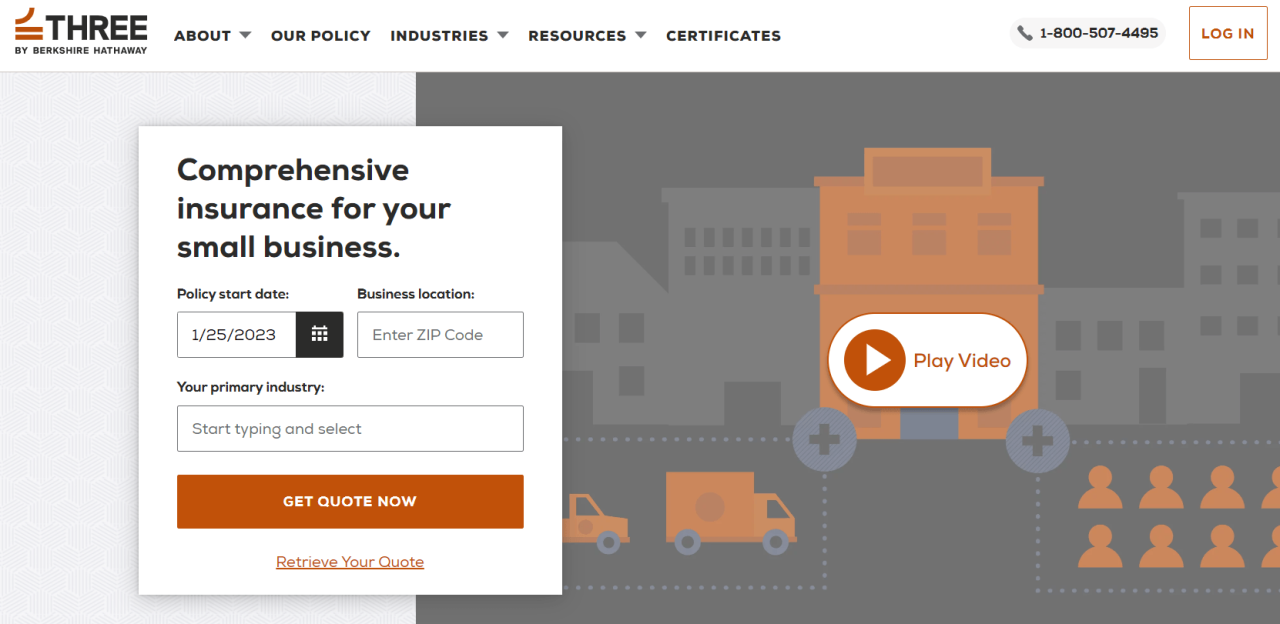

Biberk Insurance is a specialized insurance provider that caters to the needs of small businesses. They offer a range of insurance products designed to protect small businesses from various risks and uncertainties.

Insurance plays a crucial role in the success and sustainability of small businesses. It provides financial protection against unforeseen events such as property damage, liability claims, and business interruptions. Without adequate insurance coverage, small businesses may face significant financial losses that could potentially lead to closure.

Services Offered by Biberk Insurance

- General Liability Insurance: This coverage protects small businesses from third-party claims of bodily injury, property damage, or advertising injury.

- Commercial Property Insurance: Biberk Insurance offers property insurance to safeguard small businesses against damage or loss of physical assets such as buildings, equipment, and inventory.

- Business Interruption Insurance: In the event of a covered loss that disrupts business operations, this insurance helps small businesses cover ongoing expenses and loss of income.

- Workers' Compensation Insurance: Biberk Insurance provides workers' compensation coverage to protect small businesses from liabilities related to workplace injuries or illnesses suffered by employees.

Benefits of Biberk Insurance for Small Businesses

When it comes to protecting your small business, Biberk Insurance offers a range of benefits that set them apart from other providers. From tailored policies to risk mitigation strategies, here are some advantages of choosing Biberk Insurance:

Tailored Policies

Biberk Insurance understands that each small business is unique, which is why they offer tailored policies to suit the specific needs of your business. Whether you run a retail store, a restaurant, or a tech startup, Biberk Insurance can customize a policy that fits your industry, size, and risk profile.

Risk Mitigation

With Biberk Insurance, small businesses can effectively mitigate risks by having comprehensive coverage in place. Whether it's protection against property damage, liability claims, or cyber threats, Biberk Insurance ensures that your business is safeguarded from unforeseen events that could potentially disrupt your operations.

Competitive Rates

Despite offering tailored policies and comprehensive coverage, Biberk Insurance also provides competitive rates for small businesses. This means that you can protect your business without breaking the bank, allowing you to allocate your budget efficiently while still having peace of mind knowing that you're covered.

Customer Reviews and Testimonials

Customer reviews play a crucial role in gauging the effectiveness and reliability of an insurance provider like Biberk Insurance for small businesses. Let's delve into some insights from small business owners who have used Biberk Insurance and analyze their overall satisfaction levels.

Customer Feedback and Experiences

- Many small business owners have praised Biberk Insurance for its seamless online application process, which saved them time and hassle.

- Customers have highlighted the exceptional customer service provided by Biberk Insurance representatives, who were quick to address any queries or concerns.

- Several reviews have mentioned the competitive pricing offered by Biberk Insurance, making it an affordable option for small businesses looking for comprehensive coverage.

- Small business owners have appreciated the customizable insurance plans offered by Biberk Insurance, allowing them to tailor their coverage to specific needs.

Overall Satisfaction Levels

Based on the reviews and testimonials, small businesses seem to be highly satisfied with the services provided by Biberk Insurance. The combination of user-friendly online tools, responsive customer support, competitive pricing, and customizable plans has earned Biberk Insurance a positive reputation among small business owners.

Cost and Pricing Structure

When it comes to the cost and pricing structure of Biberk Insurance policies for small businesses, it's important to consider the affordability and value they offer. Here we will delve into the typical cost range, comparisons to other providers, and any unique pricing structures or discounts available.

Typical Cost Range

Biberk Insurance policies for small businesses typically range from $500 to $1500 per year, depending on the coverage limits, industry risks, and the size of the business. This range is competitive and offers good value for the coverage provided.

Comparison to Other Insurance Providers

Compared to other insurance providers in the market, Biberk Insurance offers competitive pricing without compromising on the quality of coverage. While some providers may offer lower premiums, they may not provide the same level of comprehensive coverage tailored for small businesses.

Unique Pricing Structures and Discounts

Biberk Insurance stands out by offering unique pricing structures and discounts for small businesses. They may offer discounts for bundling multiple policies, implementing risk management practices, or having a claims-free history. These discounts can help small businesses save on their insurance costs while still getting the coverage they need.

Closing Summary

In conclusion, the discussion surrounding Biberk Insurance for small businesses unveils a tapestry of advantages, tailored services, and customer satisfaction that solidify its position as a trusted insurance provider in the market.

Key Questions Answered

What types of insurance does Biberk Insurance offer for small businesses?

Biberk Insurance offers a range of policies including liability insurance, property insurance, and business interruption insurance tailored for small businesses.

How does Biberk Insurance handle claims from small businesses?

Biberk Insurance has a streamlined claims process for small businesses, ensuring quick and efficient resolution to minimize disruptions.

Are there any specific industries that Biberk Insurance specializes in for small business coverage?

While Biberk Insurance caters to various industries, they have specialized packages for sectors like technology, healthcare, and retail.

Does Biberk Insurance offer any discounts for small businesses with multiple policies?

Yes, Biberk Insurance provides discounts for small businesses that opt for multiple policies, helping them save on overall insurance costs.