Exploring the Differences: Business Loan vs Business Line of Credit

When it comes to financing options for your business, understanding the disparities between a business loan and a business line of credit is crucial. This comprehensive guide will delve into the intricacies of both financial tools, shedding light on their unique features and benefits.

Whether you're a seasoned entrepreneur or a budding startup, grasping the distinctions between these two funding sources can significantly impact your business's financial health and growth potential.

As we navigate through the details of business loans and lines of credit, you'll gain valuable insights into when to leverage each option effectively, empowering you to make informed decisions that align with your business objectives.

Table of Contents

ToggleBusiness Loan

When a business needs funding for various purposes such as expansion, purchasing equipment, or managing cash flow, they can opt for a business loan. This type of financing provides a lump sum amount that needs to be repaid over a fixed term with interest.

Typical Requirements for Obtaining a Business Loan

- A solid business plan outlining the purpose of the loan and how it will be repaid

- Good personal and business credit history

- Certain level of revenue and profitability

- Collateral may be required for secured loans

Types of Business Loans Available

- Term Loans: Fixed amount repaid over a set period with a fixed or variable interest rate

- SBA Loans: Government-backed loans with favorable terms for small businesses

- Equipment Loans: Specifically for purchasing equipment with the equipment serving as collateral

- Business Lines of Credit: Revolving credit line with a predetermined limit that can be used when needed

Situations Where a Business Loan is More Suitable

- One-time large expenses like purchasing real estate or equipment

- Long-term investments that require a fixed amount of capital

- Projects with specific timelines and budgets

Business Line of Credit

A business line of credit is a flexible type of financing that allows businesses to borrow money up to a certain limit, similar to a credit card. The business can draw funds as needed and only pay interest on the amount borrowed.

Benefits of a Business Line of Credit for Small Businesses

- Provides access to funds for short-term needs or emergencies

- Helps with managing cash flow fluctuations

- Offers flexibility in borrowing and repaying funds

- Can help build a business credit history

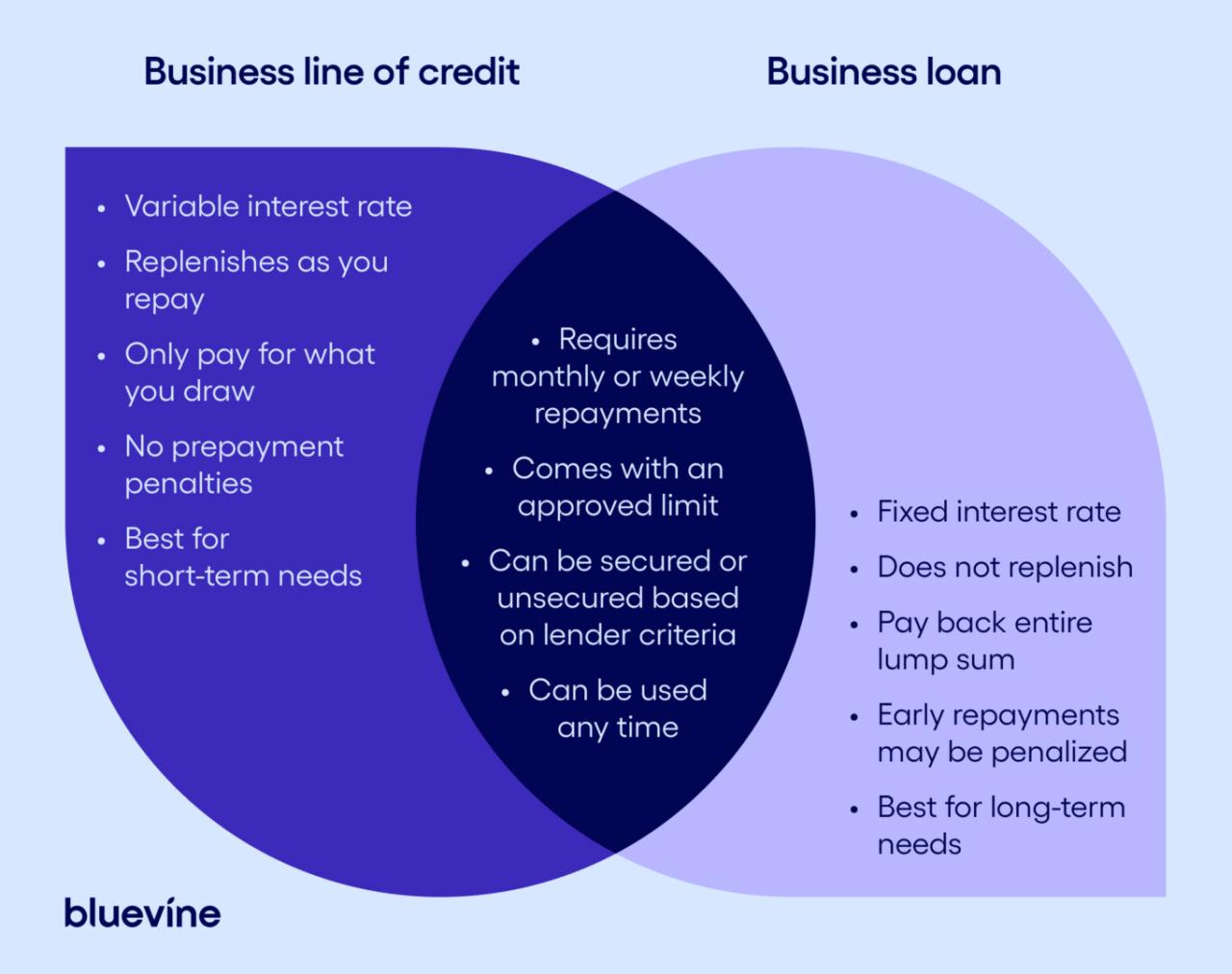

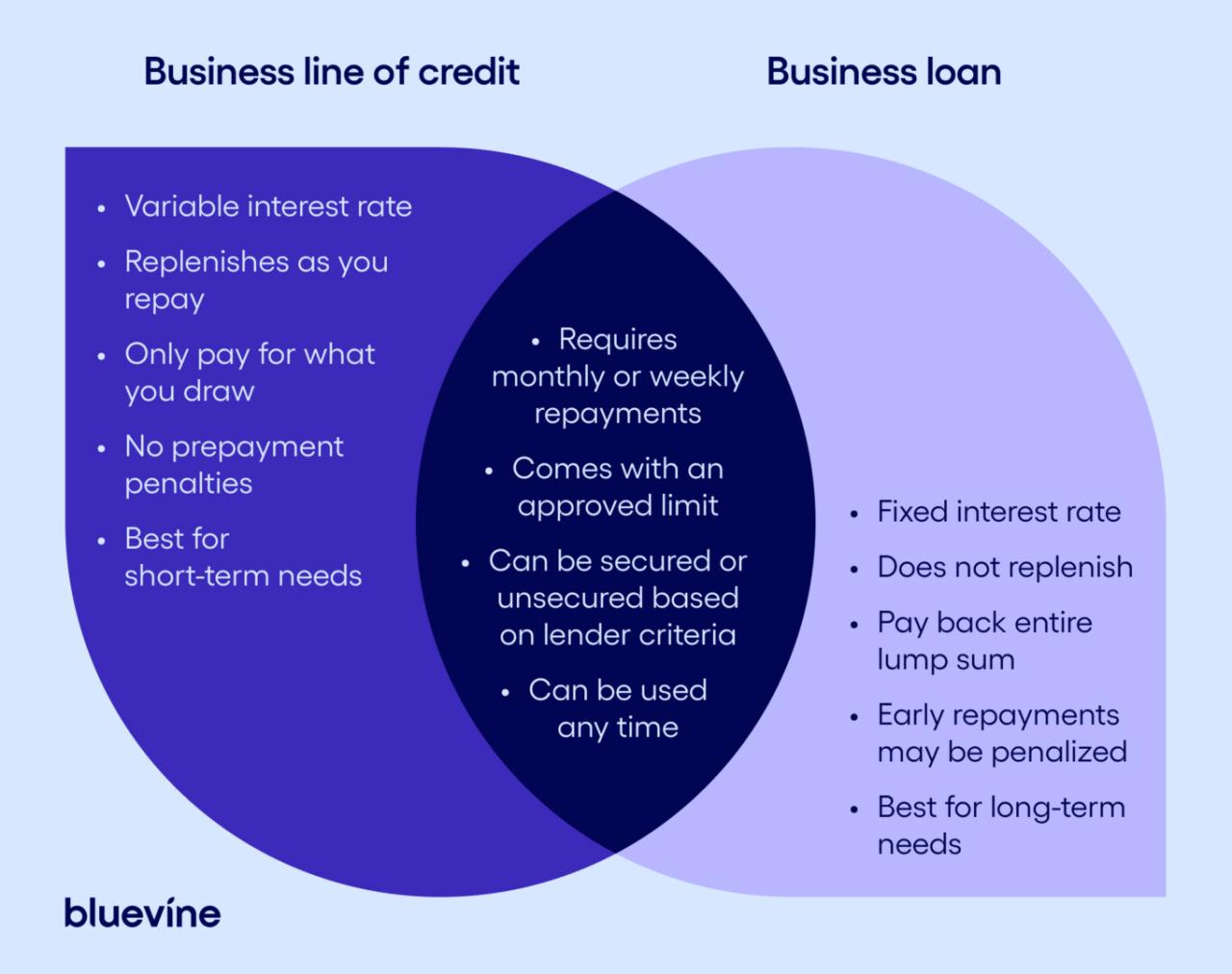

Differences between a Business Line of Credit and a Business Loan

- A business line of credit is revolving, while a business loan is a one-time lump sum

- Interest is only paid on the amount borrowed with a line of credit, unlike a loan where interest is paid on the full amount

- With a line of credit, funds can be borrowed again once repaid, whereas a loan requires a new application for additional funds

Advantages of a Business Line of Credit over a Traditional Loan

- When a business needs quick access to funds for short-term needs

- For managing seasonal fluctuations in cash flow

- When the business is uncertain about the exact amount needed and wants the flexibility to borrow as needed

Application Process

When it comes to applying for financial assistance for your business, whether in the form of a loan or a line of credit, the application process plays a crucial role in determining how quickly you can access the funds you need.

Here's a breakdown of the steps involved in applying for a business loan versus a business line of credit, along with the documentation required and the timeline for approval and funding.

Business Loan Application Process

- Research and Compare Lenders: Start by researching different lenders and comparing their loan options, interest rates, and terms to find the best fit for your business.

- Prepare Your Documents: Gather necessary documents such as financial statements, tax returns, business plan, and any other relevant paperwork required by the lender.

- Fill Out the Application: Complete the loan application form provided by the lender, providing accurate information about your business, finances, and the purpose of the loan.

- Submit Application and Wait for Approval: Once you submit your application, the lender will review your documents and financial history to determine your eligibility for the loan.

- Receive Approval and Funding: If your application is approved, you will receive the loan agreement to sign, and the funds will be disbursed to your business account.

Business Line of Credit Application Process

- Choose a Lender: Select a lender that offers a business line of credit with terms that align with your business needs and financial goals.

- Submit Initial Application: Fill out the initial application form provided by the lender to start the process of applying for a business line of credit.

- Provide Additional Documentation: In addition to basic business information, you may need to provide financial statements, tax returns, and other documents to support your application.

- Approval and Credit Limit Determination: The lender will review your application and financial history to approve your line of credit and determine the credit limit based on your business's financial health.

- Access Funds as Needed: Once approved, you can access funds from your business line of credit as needed, up to the approved credit limit.

Documentation required for both a business loan and a business line of credit typically includes financial statements, tax returns, business plan, proof of ownership, and personal identification.

While the approval process for a business loan may take a few weeks to a few months, a business line of credit can be approved more quickly, with funds available for use almost immediately after approval.

Repayment Terms

Business loans and lines of credit have different repayment terms that businesses need to consider when choosing the right financing option. Let's delve into the specifics of repayment terms for both options.

Repayment Terms for Business Loan

When it comes to business loans, repayment terms typically involve fixed monthly payments over a set period of time. These payments include both principal and interest, with the interest rate determined at the time of borrowing. The interest rates for business loans can be fixed or variable, depending on the type of loan and the lender.

Businesses need to adhere to the repayment schedule to avoid any penalties or negative impacts on their credit score.

Repayment Terms for Business Line of Credit

On the other hand, a business line of credit offers more flexibility in terms of repayment. Businesses can access funds as needed, up to a predetermined credit limit, and only pay interest on the amount borrowed. Repayment works more like a credit card, where businesses can borrow, repay, and borrow again without having to reapply.

The interest rates for lines of credit are typically variable and may be lower than those for business loans.

Differences in Repayment Terms

In scenarios where businesses need a lump sum of money for a specific project or investment, the repayment terms of a business loan may be more favorable. This is because businesses can budget for fixed monthly payments and know exactly when the loan will be fully repaid.

On the other hand, a line of credit may be more suitable for businesses with fluctuating cash flow or ongoing working capital needs.

Flexibility in Repayment Options

Both business loans and lines of credit offer flexibility in repayment options. For loans, businesses can choose between shorter or longer repayment terms, depending on their financial situation and goals. Lines of credit, on the other hand, allow for ongoing access to funds without the need to reapply for a new loan each time.

This flexibility can be beneficial for businesses facing unpredictable expenses or seasonal fluctuations in revenue.

Conclusive Thoughts

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)

In conclusion, the choice between a business loan and a business line of credit ultimately depends on your specific financial needs and circumstances. By weighing the advantages and drawbacks of each option, you can strategically utilize these financial instruments to propel your business forward.

Remember, informed decision-making is key to securing the financial stability and growth of your enterprise.

FAQ Corner

What are the typical requirements for obtaining a business loan?

Business loans usually require a solid credit score, business plan, financial statements, and collateral.

How does a business line of credit differ from a traditional loan?

A business line of credit provides flexibility in borrowing and repaying funds, similar to a credit card, while a traditional loan offers a lump sum amount with fixed repayment terms.

What is the application process like for a business line of credit?

Applying for a business line of credit involves submitting an application, providing financial documents, and undergoing a credit check.

Related posts

The Best Business Line of Credit for Contractors

Featured Posts

- Exploring Xfinity Business WiFi Packages for Contractors

- Exploring Business Credit Options for Construction Companies

- Xfinity Business Internet Review for Small Business: A Comprehensive Guide

- Crafting the Right Protection: Biberk General Liability Insurance for Roofers

- The Best Business Line of Credit for Contractors

Popular Tags

banking (2) Biberk business insurance (1) biberk insurance (2) business account (2) business banking (2) business checking (1) business credit (8) business financing (2) business insurance application (1) business protection (1) cash flow management (1) construction industry (2) construction LLCs (1) Contractors (2) credit building (1) financial management (9) financial strategies (1) growth opportunities (1) home improvement companies (1) insurance premiums (1) insurance reviews (1) insurance tips (1) liability coverage (2) risk management (1) siding company (2) small business (3) small business insurance (2)