Business loans vs. venture capital: Which is better?

Exploring the differences between business loans and venture capital can shed light on the best financing options for entrepreneurs. Let's delve into the world of business funding to uncover which avenue may be more suitable for your needs.

Business Loans

Business loans are financial products offered by lenders to provide capital to businesses for various purposes, such as expansion, equipment purchases, working capital, or other operational needs. These loans are typically repaid over a fixed term with interest.

Types of Business Loans

- Term Loans: These are traditional loans with a fixed repayment term, usually used for long-term investments.

- Line of Credit: A revolving credit line that can be tapped into as needed, with interest paid only on the amount used.

- SBA Loans: Government-guaranteed loans offered by the Small Business Administration to support small businesses.

- Equipment Loans: Specifically used to finance the purchase of equipment or machinery for the business.

Application Process for Business Loans

Applying for a business loan typically involves the following steps:

- Research and compare lenders to find the best fit for your business needs.

- Gather necessary documents, such as financial statements, tax returns, and business plans.

- Complete the application form and submit it along with the required documents.

- Wait for approval and review loan terms and conditions.

- If approved, sign the loan agreement and receive funds in your business account.

Interest Rates of Business Loans

Interest rates for business loans can vary depending on the lender, the type of loan, the creditworthiness of the borrower, and current market conditions. Generally, interest rates for business loans range from 4% to 30%. It's essential to compare offers from different lenders to ensure you get the best rate for your business.

Venture Capital

Venture capital is a type of financing provided by investors to startup companies and small businesses with long-term growth potential. In exchange for the funding, venture capitalists typically receive equity in the company. This form of funding is crucial for businesses that require substantial capital to scale rapidly.

How Venture Capital Works

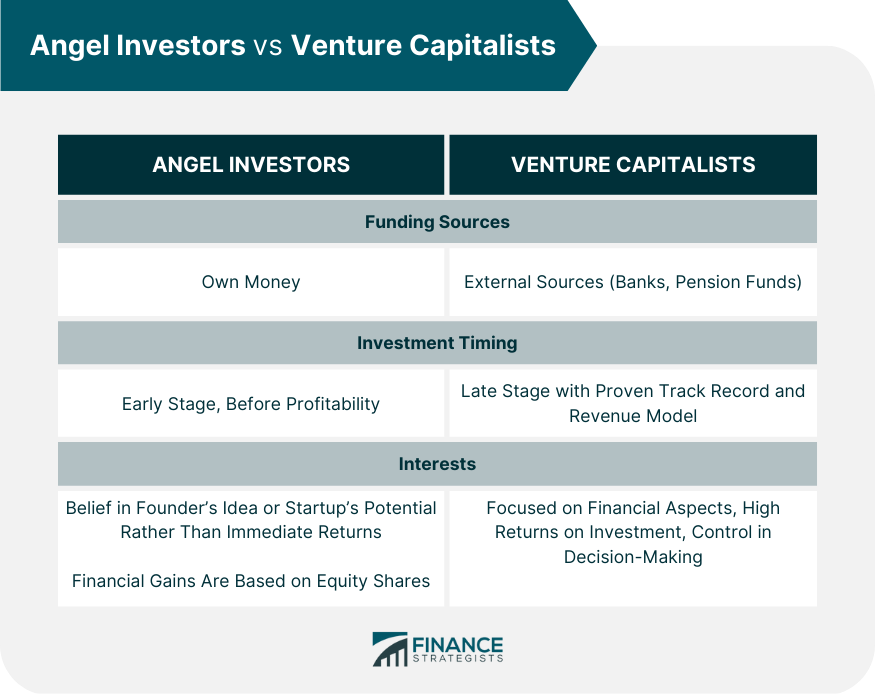

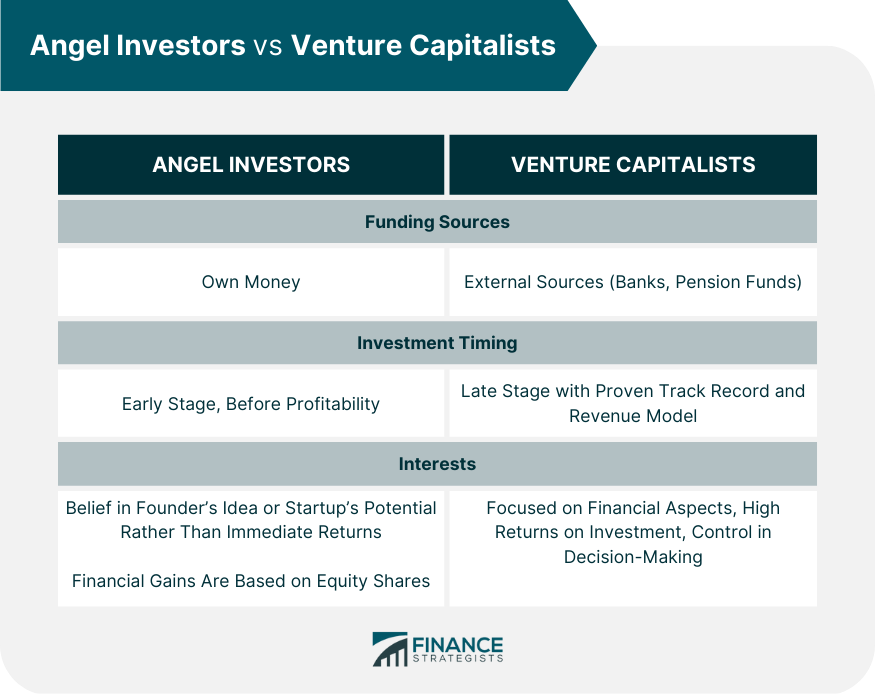

Venture capital firms raise funds from institutional investors, high-net-worth individuals, and other sources. They then invest these funds in promising startups and early-stage companies with high growth potential. Venture capitalists provide not only financial support but also mentorship, guidance, and networking opportunities to help the businesses succeed.

In return, they expect a significant return on their investment when the company goes public or is acquired.

Typical Sources of Venture Capital Funding

- Corporate venture capital (CVC)

- Angel investors

- Venture capital firms

- Crowdfunding platforms

Criteria Considered by Venture Capitalists

- Market potential and scalability of the business

- Strength of the management team

- Unique value proposition and competitive advantage

- Growth projections and exit strategy

Examples of Successful Businesses with Venture Capital Funding

- Uber: The ride-hailing giant raised significant venture capital funding in its early days, allowing it to expand globally and disrupt the traditional taxi industry.

- Facebook: Mark Zuckerberg secured venture capital funding to grow Facebook into the social media behemoth it is today, with billions of users worldwide.

- Airbnb: The online hospitality marketplace received venture capital support to revolutionize the way people book accommodations and travel.

Pros and Cons Comparison

When deciding between business loans and venture capital, it is essential to weigh the advantages and disadvantages of each option carefully. Below, we detail the benefits and risks associated with both choices to help you make an informed decision.

Advantages of Opting for a Business Loan over Venture Capital

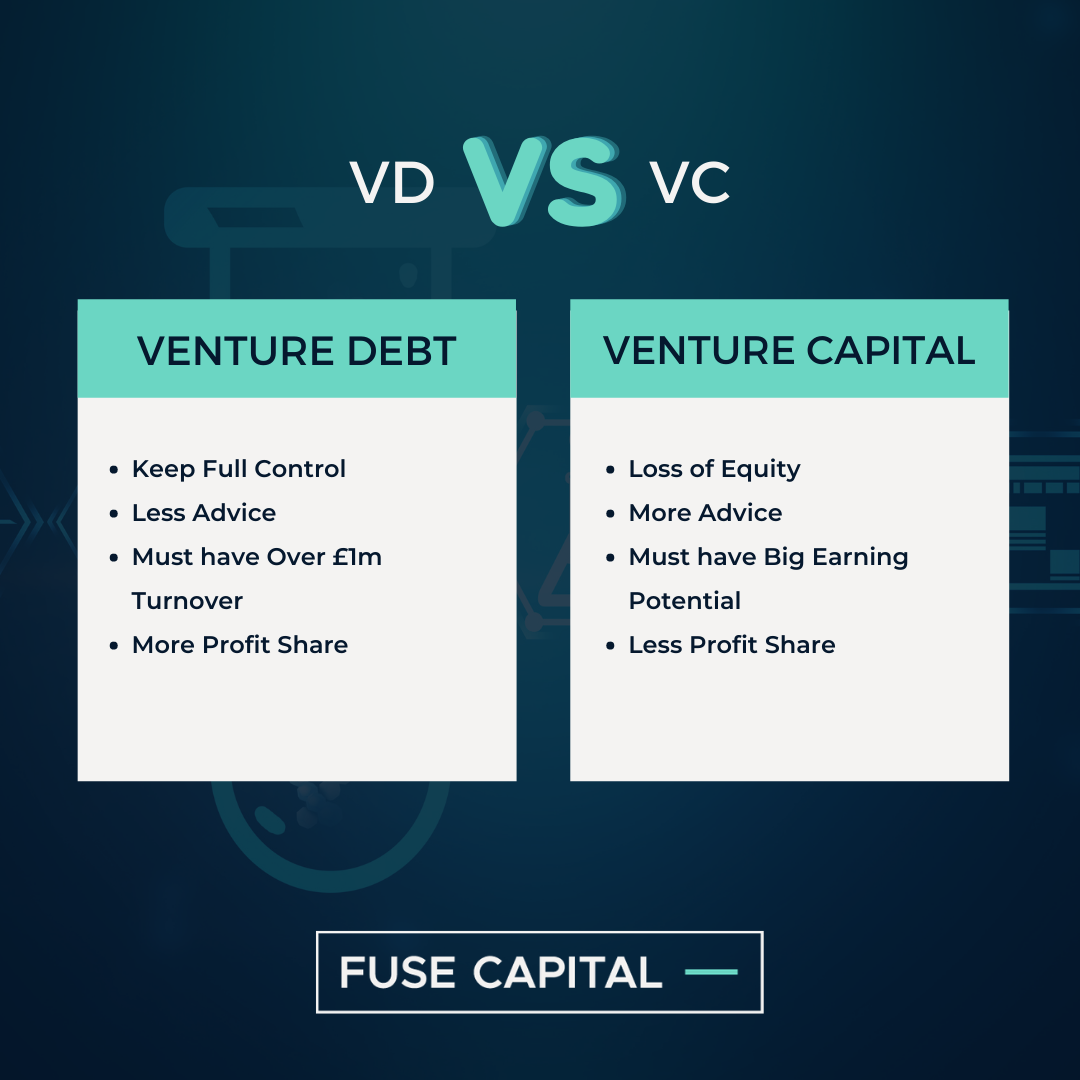

- Retain Ownership: By taking out a business loan, you maintain full control of your company without having to give up equity.

- Predictable Repayment: Business loans come with fixed repayment schedules, making it easier to plan and budget for the future.

- Build Credit: Successfully repaying a business loan can help establish and improve your company's credit history, making it easier to secure financing in the future.

Benefits of Choosing Venture Capital instead of a Business Loan

- Access to Expertise: Venture capitalists often bring valuable industry knowledge and experience to the table, helping your business grow and succeed.

- Networking Opportunities: Venture capital firms typically have extensive networks that can connect your business to potential partners, clients, and resources.

- No Repayment Required: Unlike business loans, venture capital funding does not need to be repaid, reducing the financial burden on your company in the early stages.

Contrast the Risks Associated with Business Loans versus Venture Capital

- Debt Burden: Taking out a business loan means you are responsible for repaying the borrowed amount plus interest, which can strain your company's finances if not managed properly.

- Lack of Control: Venture capitalists may have a say in the decision-making process of your business, potentially limiting your autonomy as the owner.

- High Expectations: Venture capital firms often expect high returns on their investment, putting pressure on your business to perform and grow quickly.

Key Differences Between Business Loans and Venture Capital

| Aspect | Business Loans | Venture Capital |

|---|---|---|

| Ownership | Retain ownership | May require giving up equity |

| Repayment | Fixed schedule | No repayment required |

| Control | Full control | Potential loss of control |

Wrap-Up

In conclusion, weighing the pros and cons of business loans versus venture capital is essential for making informed financial decisions. Whether you opt for traditional loans or seek out venture capitalists, understanding the nuances of each can lead to better outcomes for your business endeavors.

Question & Answer Hub

What are the main differences between business loans and venture capital?

Business loans involve borrowing money with interest, while venture capital is equity financing where investors receive a stake in the company.

Which option is more suitable for startups looking for funding?

Startups with high growth potential often opt for venture capital due to the additional benefits beyond just financial support.

Are there risks associated with taking business loans?

Yes, business loans come with the obligation to repay the borrowed amount with interest, which can strain cash flow if not managed properly.